Executive Summary:

Uniswap v4 has surpassed $300 billion in cumulative volume in under a year, outpacing previous protocol versions and highlighting DeFi’s rapid evolution. This article explores the drivers behind this growth, explains the data discrepancy with DefiLlama, and examines what this milestone means for the future of decentralized finance in 2026.

Why This Milestone Matters

Crossing the $300 billion mark in less than a year is more than a headline—it’s a signal of DeFi’s growing maturity, user trust, and mainstream adoption. Uniswap v4’s rapid ascent demonstrates:- Maturing Infrastructure: Faster, cheaper, and more flexible DEX protocols are attracting both retail and institutional users.

- Layer-2 Adoption: The shift to L2s is making DeFi more accessible and cost-effective.

- Ecosystem Confidence: Sustained high volumes and TVL reflect increasing confidence in decentralized protocols.

As DeFi continues to scale, such milestones help validate the sector’s long-term potential and resilience.

v3 vs v4: Growth Rate Comparison

| Version | Time to $300B Volume | Launch Date |

|---|---|---|

| Uniswap v3 | ~2 years | May 2021 |

| Uniswap v4 | <1 year | Jan 2025 |

L2 Volume Share (Estimates, Jan 2026)

| Chain | % of v4 Volume |

|---|---|

| Arbitrum | 28% |

| Base | 15% |

| Unichain | 8% |

| Monad | 3% |

| Ethereum | 46% |

Sample Dune Query:

sqlSELECT SUM(volume_usd) FROM swaps WHERE protocol = 'Uniswap v4';

Quote:

“V4 flexibility is crazy powerful, and it’s only the very beginning.” — @haydenadams, Uniswap Labs

Uniswap v4 has achieved a major Uniswap v4 cumulative volume milestone, surpassing $300 billion in total protocol volume less than a year after its January 2025 launch. This rapid ascent—confirmed recently by Uniswap Labs—highlights continued dominance in decentralized exchanges (DEXs) and underscores broader DeFi trends 2026 toward scalable, low-cost infrastructure.

Yet cross-checks reveal a common discrepancy: DefiLlama currently reports ~$262 billion for v4 cumulative DEX volume. This article breaks down the numbers, explains the variance, and offers insights into where DeFi in 2026 is headed.

Uniswap v4 Milestone: Efficiency and L2 Adoption Fuel Explosive Growth

Launched in late January 2025, **Uniswap v4** introduced modular hooks, superior capital efficiency, dynamic fees, and native multi-chain support—features that have accelerated adoption. With a significant portion of volume now on Layer-2 networks, gas costs have dropped notably versus v3, enabling higher throughput and attracting both retail and institutional traders.Key Uniswap v4 stats (as of January 2026):

- Cumulative Volume: Over $300 billion (per Uniswap Labs / official tracking), up sharply from earlier 2025 figures.

- Total Value Locked (TVL): ~$676 million across chains—Ethereum leads (~$448M), followed by Unichain (~$52M), Arbitrum (~$52M), Base (~$39M), and emerging chains like Monad (~$33M).

- Cumulative Fees Generated: ~$153 million, with recent 24h fees around $396K and strong 30-day totals.

- Chain Breakdown: Strong activity on Arbitrum, Base, and newer L2s, reflecting the ongoing shift to scalable networks in DeFi trends 2026.

Compared to v3 (which took over two years for similar milestones), v4's pace demonstrates maturing DeFi infrastructure: faster, cheaper, and more builder-friendly.

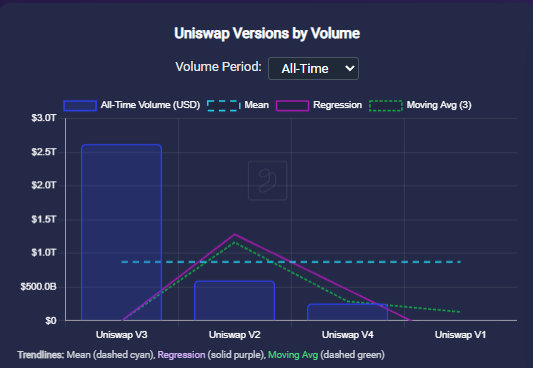

Explaining the Data Discrepancy: Uniswap v4 $300B vs DefiLlama ~$262B

A frequent point of discussion: Why does official tracking show **$300 billion** in **Uniswap v4 cumulative volume**, while DefiLlama lists approximately **$262.159 billion**?The difference stems from aggregation methods:

- Official / Dune-based tracking (used by Uniswap Labs): Relies on real-time, raw on-chain queries that capture every swap—including advanced hook-based pools and activity on newer or less-covered chains.

- DefiLlama: Aggregates from APIs, explorers, and standardized adapters, which may introduce minor lags, apply filters (e.g., excluding certain wash trades or MEV), or sync more slowly for emerging L2s like Monad or Soneium.

With daily volumes frequently in the $2–3 billion range, DefiLlama figures tend to catch up over time. This Uniswap v4 vs DefiLlama discrepancy is typical in decentralized analytics—always cross-reference primary protocol sources for the most precise view and DefiLlama for broader ecosystem context.

| Uniswap Analytics (defihub.space) Live charts and data powered by DefiLlama API. The "Uniswap Version by Volume" chart reflects the lower cumulative volume (under $300B) discussed above, providing a direct comparison to official Uniswap Labs figures. → View analytics |

|---|

Risks and Challenges Ahead

While Uniswap v4’s growth is impressive, several risks remain:

- Oracle Reliability: Accurate price feeds are critical for DEX safety and composability.

- L2 Fragmentation: As more chains launch, liquidity and user experience can become fragmented.

- Regulatory Uncertainty: Evolving global regulations may impact protocol operations and user access.

- Competition: New DEX models (perp DEXs, cross-chain aggregators) are rapidly innovating.

Ongoing monitoring and adaptation will be key for Uniswap and the broader DeFi ecosystem.

What’s Next: DeFi Trends 2026 and Uniswap v4’s Role

The **Uniswap v4 milestone** is more than a number—it's a signal of DeFi's evolution toward production-grade infrastructure. Looking ahead to **DeFi trends 2026**:- L2 Dominance & Scaling — Continued migration to Arbitrum, Base, Unichain, and new chains could push v4 well past $500 billion by mid-2026.

- Monetization Momentum — Hook-enabled dynamic fees and potential protocol revenue activation are likely to drive sustainable yields for builders and liquidity providers.

- Institutional & RWA Integration — Growing stablecoin markets and tokenized real-world assets position compliant DEXs like Uniswap to capture trillions in annual volume over time.

- Risks & Competition — Oracle reliability, L2 fragmentation, and emerging rivals (perp DEXs, cross-chain aggregators) remain key challenges to monitor.

In 2026, protocols that prioritize efficiency, interoperability, and real-world utility—like Uniswap v4—are best positioned to lead. The $300 billion Uniswap v4 milestone exemplifies the shift from experimental DeFi to scalable, widely adopted infrastructure.

For the most up-to-date figures on Uniswap v4 growth and the DeFi 2026 outlook, check primary sources:

- Uniswap Labs announcements

- DefiLlama Uniswap v4 page

- Official Dune dashboards (search Uniswap v4)

This article was last updated January 25, 2026. DeFi metrics evolve quickly—always verify with multiple sources.

Data as of Jan 25, 2026; subject to real-time changes.