Binance Alpha and the Cost of Gatekeeping

Binance Alpha was introduced as an early-access engagement program — a way for users to discover emerging tokens before broader listings. In practice, it has become a case study in how centralized gatekeeping shapes outcomes across crypto markets.

The controversy surrounding Alpha is not merely about individual token performance or short-term price action. It reflects deeper structural incentives inherent to centralized exchanges (CEXs): discretionary access, asymmetric information, and monetized liquidity control. These dynamics increasingly contrast with permissionless DeFi launch models, accelerating a broader shift in how projects raise capital and distribute ownership.

This Insight examines Binance Alpha not as an isolated failure, but as a systemic signal.

The Incentive Problem Behind CEX Gatekeeping

Centralized exchanges sit at a powerful junction: they control visibility, liquidity, and legitimacy. Programs like Binance Alpha formalize this role by curating early-stage tokens — but curation is never neutral.

Projects entering Alpha often face layered requirements:

- Significant token allocations (commonly 8–12%)

- Airdrops or incentive campaigns favoring existing exchange users

- Liquidity deposits or market-making commitments

- Tokenomic restructuring to meet listing constraints

These conditions occur before meaningful price discovery. While marketed as exposure, they function economically as paid access — shifting risk downstream to projects and retail participants while exchanges monetize fees, flow, and attention.

The result is a familiar pattern: rapid hype, constrained supply, asymmetric distribution, followed by volatility once broader markets engage.

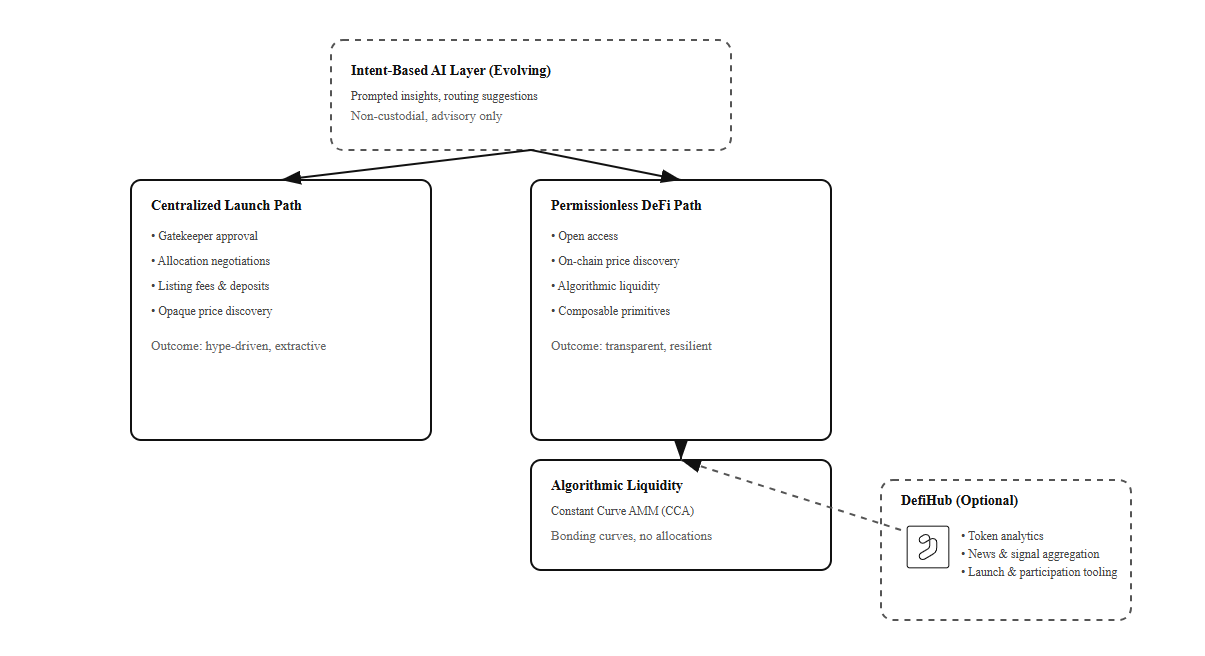

CEX vs DeFi Launch Paths

Observable Outcomes: Symptoms, Not Anecdotes

Data from 2025–2026 paints a consistent picture. Of the hundreds of tokens launched through Alpha-style programs, a large majority now trade well below their post-listing highs. Participation has declined sharply as outcomes became predictable.

Common symptoms include:

- Whale-favored airdrops with limited retail upside

- Short-lived price discovery windows

- Post-launch drawdowns exceeding 70–90%

- Delistings or liquidity decay once incentives expire

For projects, this dynamic erodes long-term credibility. For users, it reinforces the perception that early access is extractive rather than participatory.

Ripple Effects Beyond Binance

The impact extends beyond a single exchange. Repeated cycles of hype and drawdown contribute to broader narrative damage across crypto markets:

- Retail trust erosion and capital flight

- Increased regulatory scrutiny

- Media framing crypto as structurally speculative

- Hesitation from long-term and institutional participants

Even during periods of technological progress, these second-order effects suppress adoption by undermining credibility.

In this context, the backlash against Binance Alpha reflects frustration with incentives — not simply execution.

DeFi’s Evolutionary Response

DeFi’s response has not been rhetorical; it has been architectural.

Permissionless launch mechanisms replace discretionary access with transparent rules:

- Bonding curves and AMMs enable organic price discovery

- No privileged allocations or opaque listing negotiations

- On-chain liquidity bootstrapping replaces custodial gatekeeping

- Governance and incentives are observable from day one

Projects increasingly opt for decentralized venues not because they reject exchanges, but because mechanism design matters. Fair launches, community-first distribution, and composable liquidity offer resilience that curated listings struggle to match.

This shift is evolutionary, not ideological.

Why This Matters Now

As centralized platforms experiment with new engagement models, the contrast between discretionary and permissionless systems grows sharper. Programs like Alpha unintentionally accelerate DeFi’s maturation by highlighting the limits of curated access.

The question is no longer whether DeFi can compete with centralized distribution — but whether centralized gatekeeping can adapt to transparent, on-chain alternatives.

Editor’s Note

This Insight connects directly to DeFiHubSpace’s broader research into market structure, exchange influence, and alternative funding models. These themes are explored further in our upcoming whitepaper, which examines modular, transparent approaches to early participation, utility-driven access, and decentralized bootstrapping.

Our focus remains consistent: separating signal from hype by examining incentives, not narratives.

Further Reading

- Binance listing and delisting announcements

- Independent analyses of post-listing performance

- On-chain launch mechanisms and fair distribution models

- DeFiHubSpace Insights on CEX influence and market structure